Subscribe to our mailing list

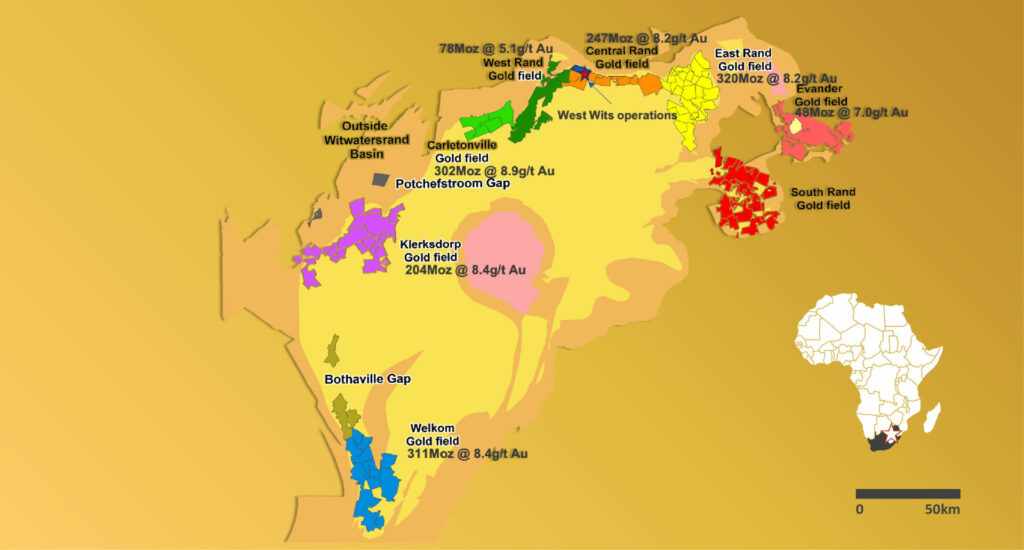

Witwatersrand Basin Project, South Africa

Quick overview

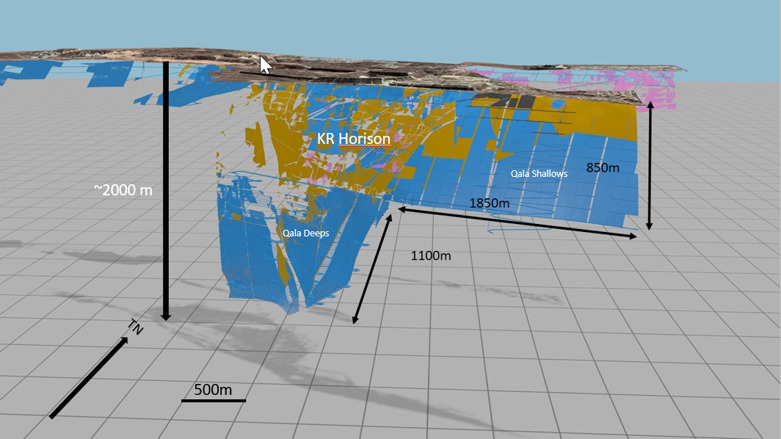

The WBP is set to transform West Wits into a long-term gold producer, with average steady state annual ROM production of 65,000oz for 25-years, over a 27-year LOM for 1.6Moz of gold.

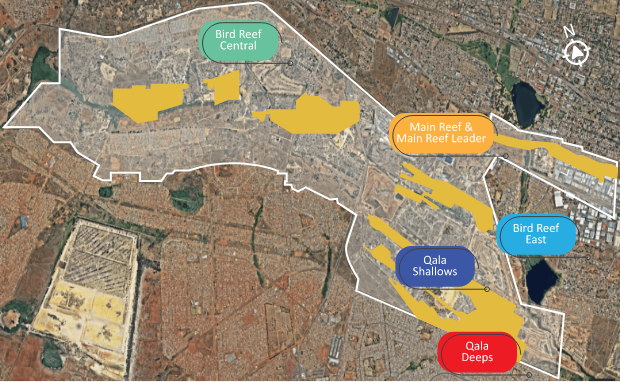

The WBP is an ambitious undertaking involving the development of three mining reefs: the Main, Kimberley, and Bird Reefs. One of our flagship projects within this development is Qala Shallows, situated on the Kimberly Reef.

Maiden 290,000oz Ore Reserve

Approx. 70% in Measured & Indicated Categories

3 distinct Reef horizons: Kimberley Reef; Bird Reef; Main Reef

Prospecting Right approval expected – will re-introduce a substantial portion of previous Mineral Resource

Background

West Wits received formal communication from South Africa’s Director-General of the Department of Mineral Resources and Energy on 19th July 2021 that the Company’s Mining Right application was granted in terms of section 23(1) of the Mineral and Petroleum Resources Development Act, 2002 (Act 28 of 2002). The Department’s decision to grant West Wits’ mining right is a pivotal milestone that heralded in the development of the WBP.

An independent scoping study was carried out by the highly regarded South African mining services firm, Bara Consulting, with results received in July 2020.

A key objective of the independent scoping study was to provide an assessment of the mining potential over the whole project area. The study confirmed the project’s distinct positive investment parameters which de-risks the project.

The CAPEX profile to recommence mining is expected to be low due to the existing historical infrastructure and planned toll treatment.

Scoping Study

The updated Scoping Study results announced in March 2022 firmly established the WBP’s potential to progress into a long-term gold mine. The results outlined an average steady-state annual production of +65,000oz with a 27-year Life-of-Mine. The results also indicated that WBP has the potential to build up to a peak production rate of 90,000 oz per annum. The Scoping Report outlined a production target which averages 76,500oz per annum from Years 5 – 16, with 92,000oz achieved in Year 6.

An updated Scoping Study is planned for 2023.

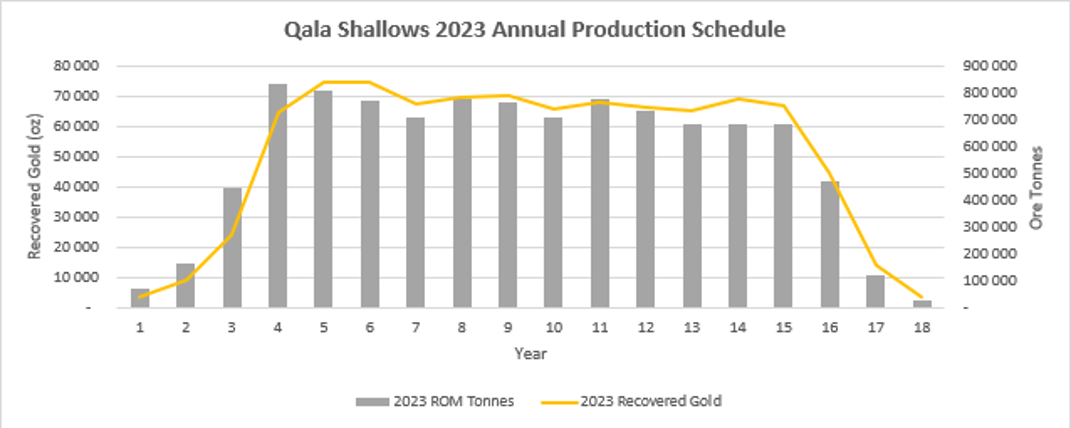

Qala Shallows

Robust Definitive Feasibility Study

Ore Reserves : 4.03 million tonnes at 2.71g/t for 351,4000 oz gold

Gold produced: 924,000oz

Steady-State production: 70,000oz p/a (9 years)

Life-of-Mine: 18 years

AISC Life-of-Mine : US$977/oz

AISC Steady-State: US$871/oz

Free Cash Flow: US$522M

Pre-Tax Project NPV7.5: US$367M

Post-Tax Project NPV7.5 : US$255M

Peak Funding: US$54M

Payback Period: 4.1 years from construction

Qala Shallows ready for rapid production ramp-up

Completed infrastructure includes:

- Change Houses and Lamp Room

- Office Complex

- Temporary Workshop

- Recently Rehabilitated Box Cut

- Run of Mine Stockpile

- Generators and Utilities

- Ventilation Shaft

In October 2022, West Wits secured a cost-effective toll treat agreement with Sibanye-Stillwater’s subsidiary. The Company continues to sustain a state of Operational Readiness at the Qala Shallows mine, maintaining established mine infrastructure and legal appointments which will enable rapid commencement of mining operations upon West Wits securing project finance.

Project 200

Based on the WBP’s encouraging Scoping Study results, West Wits decided to embark on a study to determine and assess the relevant engineering and other hurdles which would need to be resolved to achieve a further substantial increase of production with an aspirational target of 200,000oz per annum. The trade-off analysis was successful in testing the critical elements required to increase the scale of the WBP. Bara Consulting recommended that there is sufficient scope to justify the commissioning of a new Scoping Study scheduled for 2023 to assess the potential increase of production at the WBP and to determine the additional infrastructure Capex, which include a process facility, tailings storage facility and shafts and access points.

Uranium Exploration

During 2008, West Wits completed and reported results of a first pass Uranium Exploration Program at the WBP. West Wits is now recommencing investigations into the prospectivity of the uranium-bearing reefs within the Bird Reef Central area. The aim is to convert a JORC 2012 compliant exploration target of 12-16mlbs into a resource.

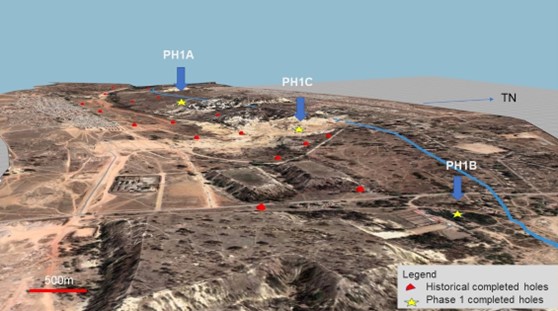

In October 2022, West Wits announced the results of the first phase of the Company’s Uranium Drilling Program with the objective to confirm historical information on the Uranium Exploration Target.

The three diamond-hole assay results are:

1.59m @ 835ppm U and 1.46g/t Au from 85.11m (PH1B – Middle Reef), including

0.96m @ 1,321ppm U and 2.30g/t Au from 85.74m

1.20m @ 108ppm U and 5.45g/t Au from 104.61m (PH1B – White Reef), including

0.49m @ 226ppm U and 12.15g/t Au from 105.32m

1.26m @ 221ppm U and 0.38g/t Au from 77m (PH1C – Middle Reef), including

0.5m @ 456pm U and 0.80g/t Au from 77.76m

The Company is highly encouraged by the grades and widths of the intercept results which confirm consistent uranium mineralisation over approximately 3.3km of the identified strike along the WBP’s Bird Reef Central area, which includes the Monarch Reef, Middle Monarch Reef and White Reef zones. A further two phases of drilling are planned and once phase 2 is completed, West Wits anticipates it will be in a position to convert the Exploration Target to a JORC compliant Inferred Mineral Resource. Phase 3 drilling is planned to test the continuous nature of the Uranium bearing reef to depths beyond 400m below surface.

View Our MD’s

Latest Update

Our MD’s Latest Update